Have you ever wondered if there’s a way to make your daily commute not only eco-friendly but also economically savvy? Imagine gliding through city streets, effortlessly reaching speeds of up to 28 mph, all while contributing to a greener future.

According to a study by the European Cyclists’ Federation, e-bikes emit about 22 grams of CO2 per kilometer, a stark contrast to the 271 grams emitted by cars. This statistic highlights the potential impact of e-bikes on reducing carbon emissions.

However, there’s a common roadblock – the cost of e-bikes. Many are discouraged by their hefty price tags, and this is where our story takes an exciting turn.

In this article, we’ll dive into the world of e-bike tax incentives. We’ll explore how these incentives can make e-bikes more accessible, discuss the legislative landscape, and examine the environmental and economic implications.

By the end, you’ll have a comprehensive understanding of the e-bike revolution and its potential to reshape urban transportation. So, let’s pedal into the world of e-bikes and discover how they’re not just changing our commute but also our environment and economy.

E-Bike Tax Incentives

If you’re considering purchasing an electric bicycle, you may be wondering if there are any tax incentives available to help offset the cost. The good news is that there are several federal and state tax credits, rebates, and incentives available for e-bike purchases.

One of the most popular federal tax credits for e-bikes is the Electric Bicycle Incentive Kickstart for the Environment (E-BIKE) Act. This act would offer a refundable tax credit amounting to 30% of the e-bike’s price, capped at $1,500. New e-bikes that cost less than $8,000 would be eligible for the refund, up from what was initially $4,000 in President Joe Biden’s original Build Back Better proposal. The new bill would give a refundable tax credit of 30% on the purchase of a new e-bike, up to $1,500.

While the E-BIKE Act has not yet been passed, it has been reintroduced to Congress several times and has gained significant support. In the meantime, some states offer their own tax credits and incentives for e-bike purchases. For example, California offers a $1,000 tax credit for the purchase of a new e-bike, while New York offers a rebate of up to $500.

It’s important to note that tax credits are different from tax deductions. A tax credit reduces the amount of tax you owe, while a tax deduction reduces your taxable income. Refundable tax credits, like the one proposed in the E-BIKE Act, can even result in a tax refund if the credit exceeds the amount of tax owed.

Overall, e-bike tax incentives can make purchasing an electric bicycle more affordable and accessible. Be sure to check with your state and local government to see if there are any additional incentives available in your area.

Legislative Context

If you’re interested in buying an e-bike, you may be wondering whether there are any tax incentives available to help offset the cost. The good news is that there have been several e-bike tax incentive bills introduced in Congress in recent years.

One of the most significant pieces of legislation related to e-bike tax incentives is the Build Back Better plan proposed by President Joe Biden. The original proposal included a tax credit of up to $4,000 for the purchase of an e-bike. However, the final version of the plan that was passed by the House of Representatives did not include this provision.

The good news is that there have been several e-bike tax incentive bills introduced in Congress in recent years.

Despite this setback, there is still hope for e-bike tax incentives at the federal level. In March 2023, the E-BIKE Act was reintroduced in Congress. This bill would provide a refundable tax credit of 30% on the purchase of a new e-bike, up to $1,500. The bill has already gained support from the Congressional Bike Caucus and several co-sponsors.

If you’re interested in e-bike tax incentives, it’s important to keep an eye on legislative developments at both the federal and state levels. While there is no guarantee that any specific bill will become law, the growing interest in e-bikes and the potential environmental benefits they offer make it likely that lawmakers will continue to consider e-bike tax incentives in the future.

Environmental Impact

One of the main reasons why e-bike tax incentives are being proposed is to reduce the environmental impact of transportation. As more people use e-bikes instead of cars, the hope is that there will be a decrease in carbon emissions and a shift towards cleaner energy.

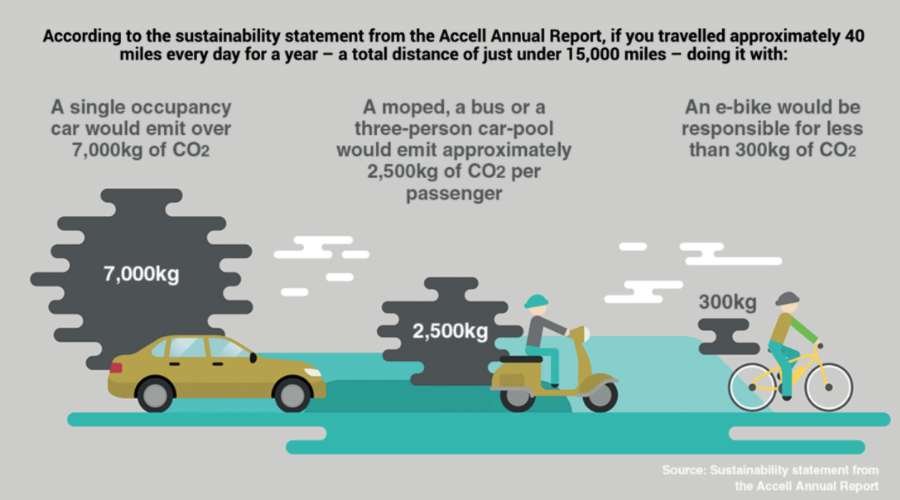

According to a study by the European Cyclists’ Federation, e-bikes emit about 22 grams of CO2 per kilometer, while cars emit about 271 grams of CO2 per kilometer. This means that e-bikes have a much smaller carbon footprint compared to cars.

Furthermore, e-bikes can also help fight climate change by reducing the number of cars on the road, which can lead to less traffic congestion and fewer emissions. This can have a significant impact on the environment, especially in urban areas where traffic is a major contributor to air pollution.

Overall, e-bike tax incentives have the potential to make a significant impact on the environment by encouraging more people to use e-bikes instead of cars. However, it is important to note that e-bikes are not a panacea for the climate crisis, and other measures will also be needed to address the root causes of climate change.

Economic Considerations

When considering the effectiveness of E-Bike tax incentives, it is important to take into account the economic factors at play. One of the most significant considerations is the purchase price of an E-Bike. While these bikes can be a great investment for those who use them regularly, they can also be quite expensive, which may deter many potential buyers.

This is where tax incentives come in. By offering a tax credit to those who purchase an E-Bike, the hope is that more people will be able to afford them, increasing their popularity and use.

However, it is also important to consider income limits when evaluating the effectiveness of E-Bike tax incentives. While the proposed tax credit is generous, it is only available to those who fall within certain income brackets. This means that those who earn above a certain amount may not be eligible for the credit, which could limit the number of people who are able to take advantage of the incentive.

By offering a tax credit to those who purchase an E-Bike, the hope is that more people will be able to afford them, increasing their popularity and use.

Another factor to consider is the potential impact on local economies. By encouraging more people to use E-Bikes, there could be a boost in demand for bike shops, repair services, and other related businesses. This could be especially beneficial for lower-income individuals who may be looking for income earning opportunities.

Overall, the effectiveness of E-Bike tax incentives will depend on a number of economic factors, including the purchase price of the bikes, income limits, and their impact on local economies. While they have the potential to be a great investment for many people, it is important to carefully evaluate their effectiveness before implementing them on a large scale.

Safety and Infrastructure

In the realm of e-bikes, prioritizing safety is paramount. Fortunately, the industry has taken significant steps to ensure that e-bikes are safe for riders. Underwriters Laboratory (UL) has established safety standards for e-bikes, which are designed to ensure that they are safe to ride, and that they meet certain criteria for durability, stability, and other factors.

Of course, safety isn’t just about the e-bikes themselves. It’s also about the infrastructure that supports them. Biking is an alternative form of transportation that requires accessible and safe infrastructure. In cities like Denver and New York City, there have been significant infrastructure improvements in recent years to make biking safer and more accessible. This includes the addition of bike lanes, protected bike paths, and other measures that help to keep bikers safe on the road.

However, there is still much work to be done to make biking and e-biking safer. The lack of infrastructure in many areas can make it difficult for bikers to travel safely. For example, if there are no designated bike lanes or bike paths, bikers may have to share the road with cars and other vehicles, which can be dangerous.

Overall, while e-bike tax incentives can help to make e-bikes more affordable and accessible, it’s important to ensure that the necessary safety measures and infrastructure improvements are in place to make e-biking a safe and viable form of transportation.

Understanding E-Bikes

If you’re not familiar with e-bikes, they are essentially electric bicycles that have a motor and battery to assist with pedaling. They are becoming increasingly popular due to their ability to make cycling easier and more accessible for a wider range of people. E-bikes can be used for commuting, leisure, and even off-road adventures.

Pedal-assist e-bikes require the rider to pedal in order to activate the motor, while throttle-controlled e-bikes have a hand-operated throttle that can be used to control the motor.

E-bikes come in different types, including pedal-assist and throttle-controlled. Pedal-assist e-bikes require the rider to pedal in order to activate the motor, while throttle-controlled e-bikes have a hand-operated throttle that can be used to control the motor. E-bikes can also have different levels of assistance, allowing the rider to choose how much help they want from the motor.

One of the benefits of e-bikes is that they can reach speeds of up to 28 mph (45 km/h), making them a viable alternative to cars for short to medium distance trips. They also have a longer range than traditional pedal bicycles, which means you can travel further without getting tired.

There are many different brands and models of e-bikes available, ranging from affordable options like the Lectric XP Lite to high-end models that cost several thousand dollars. When choosing an e-bike, it’s important to consider factors like range, motor power, and battery life.

In the next section, we’ll take a look at how e-bike tax incentives work, and whether they are truly effective at promoting the use of electric vehicles.

Key Players and Perspectives

When it comes to E-Bike tax incentives, there are several key players and perspectives to consider. Here are some of the most significant:

- Electrek: This popular electric vehicle news site has been a vocal supporter of E-Bike tax incentives, arguing that they are an effective way to promote sustainable transportation. According to Electrek, the proposed tax credits would make E-Bikes more affordable for many people, which could help to reduce dependence on gas-powered cars and reduce greenhouse gas emissions.

- PeopleForBikes: This national advocacy group has been pushing for E-Bike tax incentives for several years. According to PeopleForBikes, the proposed tax credits would help to make E-Bikes more accessible to a wider range of people, including those who might not be able to afford them otherwise. The group argues that this could help to promote healthier and more sustainable transportation options.

- Rad Power Bikes: As one of the largest E-Bike manufacturers in the US, Rad Power Bikes has a significant stake in the debate over tax incentives. The company has been a vocal supporter of the proposed tax credits, arguing that they would help to make E-Bikes more affordable and accessible for many people. Rad Power Bikes has also argued that E-Bikes are a safer and more sustainable alternative to gas-powered cars.

- David Zipper: As a transportation expert and former director of Smart Cities for the city of Washington, DC, David Zipper has been closely following the debate over E-Bike tax incentives. According to Zipper, the proposed tax credits could be an effective way to encourage more people to make the switch to E-Bikes. However, he also notes that there are several challenges that need to be addressed, such as concerns over fires and other safety issues.

- Slate: This popular online news site has been covering the debate over E-Bike tax incentives from a critical perspective. According to Slate, the proposed tax credits could be an effective way to promote sustainable transportation. However, the site also notes that there are several potential drawbacks to the plan, such as the fact that the tax credits would be fully refundable, which could lead to fraud and abuse.

- Electric Moped: While most of the debate over E-Bike tax incentives has focused on traditional bicycles, there is also growing interest in electric mopeds. Some advocates argue that tax incentives should be extended to electric mopeds as well, as they can be a more practical and efficient alternative to gas-powered cars.

Overall, there are many different perspectives on the issue of E-Bike tax incentives. While some see them as an effective way to promote sustainable transportation, others are more skeptical of their potential impact. Ultimately, the success of any tax incentive plan will depend on a variety of factors, including how it is structured and implemented, as well as broader trends in the transportation industry.